Where Purpose Meets Experience-Driven Luxury

When we founded VEA Capital Partners in January 2025, we made a deliberate decision, our first investment wouldn’t just be strategic, it would be symbolic. It would represent what we stand for: human-centred capital, conviction-led partnerships, and long-term value over short-term hype. That decision led us straight to Safari Architects.

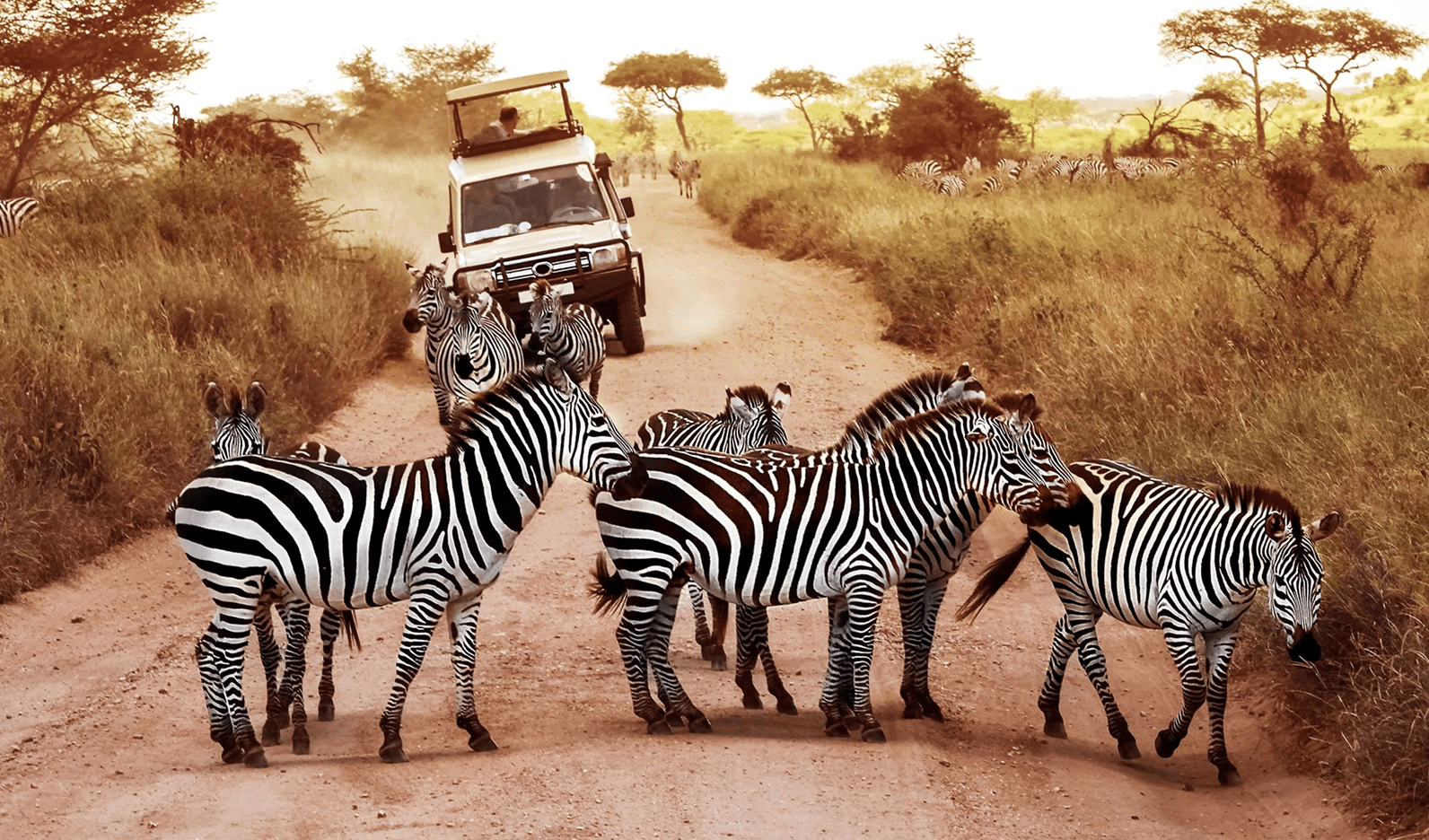

Safari Architects is not just a luxury safari travel business. It is a category creator, an experience architecture firm that curates deeply personal, bespoke journeys through Africa’s most majestic wild spaces. From the floodplains of the Okavango Delta to the misty highlands of Rwanda, their team has consistently crafted once-in-a-lifetime experiences for discerning travellers across the world.

But what drew us in was not just the beauty of the experiences they deliver. It was the operational discipline, vision-led leadership, and relentless attention to detail they embody all traits that resonate deeply with our own investment philosophy.

Understanding the Opportunity: The New Frontier of Experience Capital

In a world increasingly driven by convenience and instant gratification, Safari Architects represents the opposite: considered luxury, meticulous storytelling, and the rare ability to create emotional equity, not just economic value.

The experience economy is growing exponentially, particularly in the ultra-luxury segment. But not all experiences are created equal. Where some sell packaged moments, Safari Architects creates memory architecture. Their itineraries are not assembled, they are designed, hosted, and lived alongside their clients. This is an operator with unmatched trust, a network of the most exclusive African properties, and a reputation that precedes the brand.

Our due diligence confirmed what we hoped: this is a business built on substance. An agile, profitable team with exceptional on-the-ground execution, loyal repeat clientele, and founder integrity that’s impossible to manufacture.

What the Deal Looks Like

VEA Capital Partners acquired a strategic equity stake in Safari Architects in Q1 2025. While the specifics of the transaction remain confidential, the partnership includes:

- Capital injection for growth and new market expansion.

- Strategic advisory on operational scaling and financial modelling.

- Access to our global network of partners, investors, and luxury-facing businesses.

- Support for hiring, digital transformation, and execution.

This is not a passive capital play. It is a hands-on, high-touch, values-aligned collaboration. We sit side by side with the Safari Architects team, helping refine internal structures, grow their customer acquisition channels, and explore synergies with our wider portfolio.

Backing People, Not Just Businesses

At the centre of this deal are the people. The founding team of Safari Architects have proven themselves as stewards of Africa’s most precious stories. What makes them exceptional is not just their operational strength, but their character. In every discussion, they demonstrated humility, hunger, and an obsession with client experience that mirrors our own approach to capital.

We don’t back businesses run by figureheads. We back operators and Safari Architects is led by a team that has walked the rivers, tracked the wildlife, and hosted clients in real time. Their knowledge is lived. Their relationships are earned.

Where We’re Going Next Together

Our vision is to scale Safari Architects carefully. More volume is not the goal. Better experiences, deeper customer engagement, stronger storytelling, and more sustainable luxury is. Together, we are working on:

- Global Expansion: Targeting key U.S., EU, and UAE-based clientele through strategic partnerships and referral networks.

- Succession Planning: Investing in team capability and long-term succession to ensure the brand outlives its founders.

We are committed to growing the business without diluting its essence, ensuring each client still feels like they’re being hosted by someone who’s walked that path before.

Why This Deal Matters for VEA Capital Partners

Safari Architects affirms what we believe: real value is built through trust, execution, and integrity. It also sets the tone for how we operate. We don’t just enter deals. We build legacies.

This partnership reflects the future of what we call “experience capital”, where return on emotion and return on investment meet. Where the memory becomes the metric. Where client relationships are as long-lasting as any asset on the balance sheet.

We’re proud that Safari Architects is our first deal. It will forever represent our belief that capital can be human, thoughtful, and transformative.

Final Word: From the Founders of VCP

“We chose Safari Architects because they represent everything we believe about the future of capital. It’s not about scale for the sake of scale, it’s about significance. They’re not just planning trips. They’re shaping legacy memories. And that’s a legacy worth investing in.”

— Zander de Witt, Co-Founder and MD

— Reinhardt Rood, Co-Founder and CEO